|

NATIONAL PARK SERVICE

Golden Places The History of Alaska-Yukon Mining |

|

CHAPTER 9

The Progress of Mining

Early Mining Methods

The early miners in Alaska relied upon simple techniques in seeking and gathering gold. A prospector searched for smaller streams and former streambeds that seemed promising, according to his individual experience and theories regarding favorable mineral signs. At such spots that suggested possible wealth, he gathered sand or gravel into his pan, shook vigorously to settle the heavier mass. If his keenly alert eye spotted gold flecks or—God be praised!—nuggets, he got to work seriously. Good prospects encouraged the prospector to advance his technology from elemental panning to the use of a rocker.

Building a rocker did not tax the carpentry skills of most gold-seekers who could follow specific directions given in mining manuals and guides to gold fields. A typical rocker was a box about 3 feet long and 2 feet wide, made in two parts, the top being shallow, with a heavy sheet iron bottom, which is punched full of quarter-inch holes. The other part of the box was fitted with an inclined shelf about midway in its depth, which was 6 or 8 inches lower at its lower end than at its upper. Over this structure the miner placed a piece of heavy woolen blanket, then mounted it on two rockers. The miner set up his rocker near a good supply of water. He cleared away all the stones and coarse gravel, gathering the finer gravel and sand in a heap, then filled the shallow box of his rocker. With one hand the miner rocked while with the other he ladled in the water. The finer matter with the gold fell through the holes on the blanket, which checked its progress and held the fine particles of gold, while the sand and other matter pass over it to the bottom of the box and finally out of the box.

A mining manual explained the balance of the operation:

Across the bottom of the box are fixed thin slats, behind which some mercury is placed to catch any particles of gold which may escape the blanket. If the gold is nuggety, the large nuggets are found in the upper box, their weight detaining them until all the lighter stuff has passed through, and the smallest ones are held by a deeper slat at the outward end of the bottom of the box. The piece of blanket is, at intervals, taken out and rinsed into a barrel; if the gold is fine, mercury is placed at the bottom of the barrel. [1]

The rocker worked well enough, but if gold seemed plentiful an advance in mining technology was called for. Sluice boxes were the next stage. They required large quantities of water within accessible distance and enough timber for building sluice boxes. If water and wood were available, it did not take too much effort to provide a dramatic acceleration of production. As explained in the manual:

Planks are procured and formed into a box of suitable width and depth. Slats are fixed across the bottom of the box at intervals, or shallow holes are bored in the bottom, in such order that no particle could run along the bottom in a straight line and escape without running over a hole. Several of these boxes are then set up with a considerable slope, and are fitted into one another at the ends like a stovepipe. A stream of water is now directed into the upper end of the highest box. The gravel having been collected, as in the case of the rocker, it is shoveled into the upper box, and is washed downward by the strong current of water. The gold is detained by its weight, and is held by the slates or in the holes mentioned. If it is fine, mercury is placed behind the slats or in these holes to catch it. In this way about three times as much dirt can be washed as by the rocker, and consequently three times as much gold is secured in a given time. After the boxes are done with they are burned, and the ashes washed for the gold held in the wood.

The manual illuminated the seasonal difficulties of the miner and his utilization of local wood supplies:

A great number of the miners spend their time in the summer prospecting, and in the winter resort to a method lately adopted and which is called 'burning.' They make fires on the surface, thus thawing the ground until the bedrock is reached; then drift and tunnel. The pay dirt is brought to the surface and heaped in a pile until spring, when water can be obtained. The sluice boxes are then set up and the dirt is washed out, thus enabling the miner to work advantageously and profitably the year around. This method also has been found very satisfactory in places where the pay streak is at any great depth from the surface. In this way the complaint, which has been so commonly advanced by the miners and others, that in the Yukon several months in the year are lost to idleness is overcome.

Technological Progress

Early placer mining methods for the most part gave way to more advanced technology after the Klondike discovery. Underground drift mining was an expedient that took advantage of permafrost ground. Miners could dig underground from their entry shaft without extensive shoring of tunnels with timber and without the need to pump away excess water. Yet drift mining was basically a pick-and-shovel method of production, slow and cumbersome and capable of mining only bedrock, thus wasting any gold in the overburden.

Advancing from drift mining to more effective mining techniques required expensive machinery and more capital. The independent miner of the pre-Klondike period almost became an anachronism as time passed, yet the transition was inevitable under the circumstances. Costs of mining in Alaska were always higher than elsewhere because of freight charges and peculiar ground conditions.

Established western mining methods included open-cut, hydraulic, and dredging. All of these were used singly or in combination in Alaska depending upon conditions, but there were some adaptations of each method in the North. Each had its disadvantages. Open-cut mining required the use of steam scrapers and other heavy expensive equipment so it was not commonly practiced. Hydraulic mining, used in combinations with open-cut and dredging operations, was usually a muck stripping operation. Since hydraulic operations required lots of water, a scarce item in most mining districts, its operation necessitated the construction of reservoirs, ditches, and flumes. Dredging, of course, required the bulkiest and most expensive item of equipment available. And, to aggravate the high costs of mining by any method, the factor of operating time had to be weighed. In most mining districts, the season ran from June to September, thus sharply reducing the profit-making time and lengthening the exposure time of equipment to fire, flood, and other destructive forces.

Despite all the adverse aspects of technological progress, the advance went on in Alaska. In time, the most feasible technology was employed in placer districts that warranted exploitation. Dredges were first used on Snake Creek near Nome in 1899 and in the Klondike from 1901, but their extensive use was delayed until circumstances demanded their utilization. From 1908-1915 it became increasingly obvious that all the richest ground of the upper Yukon, the Tanana, and the Seward Peninsula had yielded all it held to hand, sluicing, and drifting methods. Tests showed that the worked tailings and ground could still be mined profitably by the most advanced mining technology—meaning dredges. More and more of these expensive machines were brought in. Dredging became increasingly common from 1916, and production justified the heavy expense involved. A USGS report of 1936 shows the prominence of dredges:

Nearly 79 percent of all the placer gold produced in Alaska in 1936 was mined by dredges. The total value of the gold thus recovered was $8,905,000, of which the greater part came from 18 dredges in the Yukon region and the rest from 20 dredges in Seward Peninsula and 1 in the Kuskokwim region. This total is more than $1,200,000 in excess of the value of the gold recovered by dredges in 1935, and the quantity is about 34,000 fine ounces more. The accompanying table gives the value of the gold output and the yardage handled by Alaska dredges, beginning in 1903, the earliest year for which records are available. The total value of the gold produced by dredges since 1903 is nearly 26 percent of the total value of gold produced from all kinds of placer mining since 1880, and lately there has been a general tendency each year for a greater and greater percentage of the placer output to be mined by dredges. During 1936 the ratio of dredge production to the output from all other kinds of placer mining was nearly 2.7 to 1, and there are no signs of a diminution in dredge mining in the near future—in fact, an even higher ratio seems not unlikely. [2]

Gold Produced by Dredge Mining in Alaska, 1903-36

Year Number

of

Dredges

OperatedValue of gold

outputGravel

handled

(cubic yards)*Value of

gold recovered

per cubic

yard (cents)*1903-15 -- $12,431,000 -- -- 1916 34 2,679,000 3,900,000 69 1917 36 2,500,000 3,700,000 68 1918 28 1,425,000 2,490,000 57 1919 28 1,360,000 1,760,000 77 1920 22 1,129,932 1,633,861 69 1921 24 1,582,520 2,799,519 57 1922 23 1,767,753 3,186,343 55 1923 25 1,848,596 4,645,053 40 1924 27 1,563,361 4,342,667 36 1925 27 1,572,312 3,144,624 50 1926 32 2,291,000 5,730,000 40 1927 28 1,740,000 6,084,000 29 1928 27 2,185,000 6,371,000 34 1929 30 2,932,000 8,709,000 33.6 1930 27 3,912,600 9,906,000 39.5 1931 28 3,749,000 10,214,000 36.7 1932 25 4,293,000 10,310,700 41.6 1933 25 4,146,000 8,889,000 46.6 1934 30 6,725,000 10,445,000 64.4 1935 37 7,701,000 12,930,000 59.6 1936 39 8,905,000 14,632,000 60.9 Total -- 78,439,000 135,823,000 48.6* *Since 1915

|

| "Giants" at work, Tanana Valley. (University of Alaska) |

|

| Cold water points thawing ground, Tanana Valley. (University of Alaska) |

|

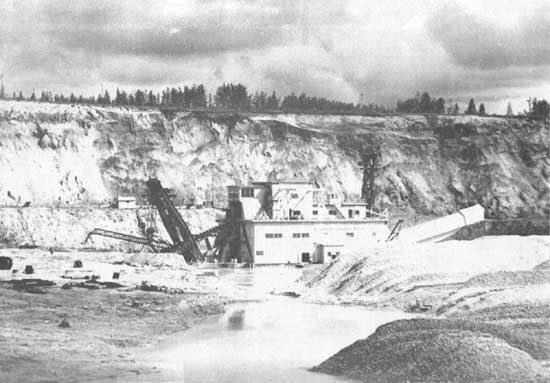

| Dredge at work. (University of Alaska) |

|

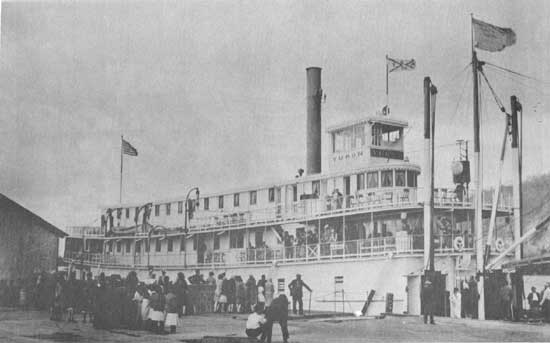

| Steamboat Yukon at Dawson. (University of Alaska) |

|

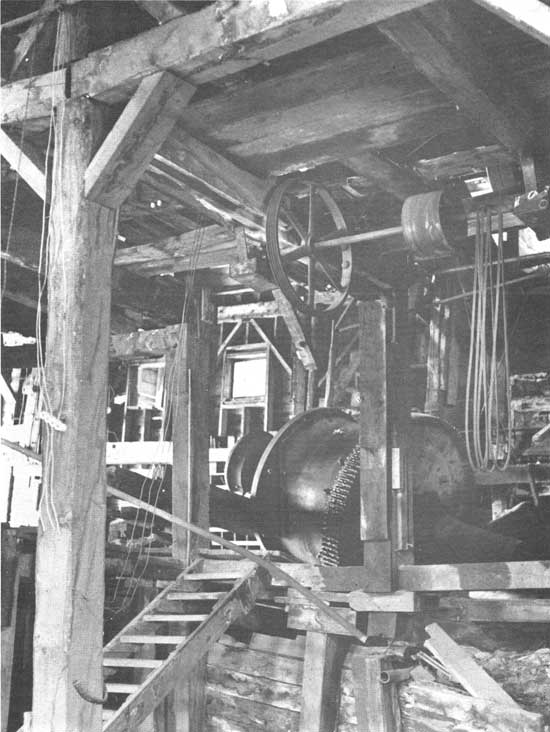

| Ball crusher at Nabesna Mining Company mill. (National Park Service) |

|

| Remains of flume system on Dan Creek. (National Park Service) |

|

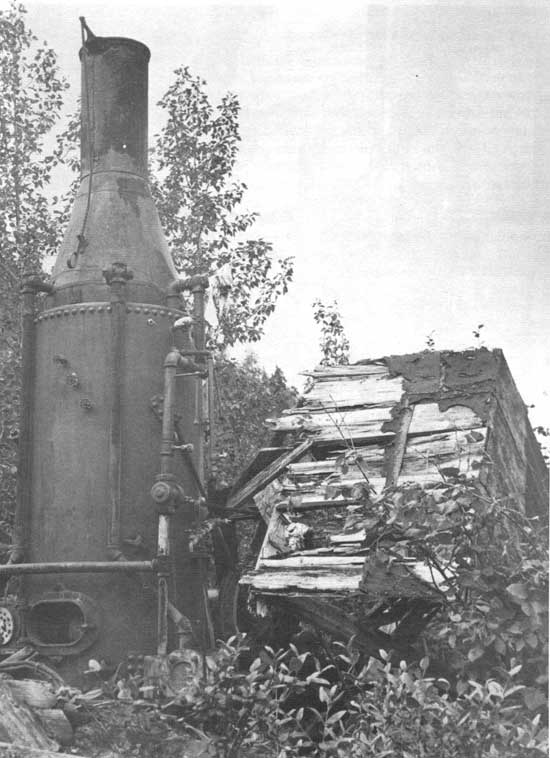

| Boiler abandoned at Nizina. (National Park Service) |

|

| Tools left at Chititu blacksmith shop. (National Park Service) |

The FE Company

The revival of interior mining with the introduction of dredges in 1916 was sustained by the entry of the Fairbanks Exploration Co. (FE Co.), a subsidiary of the United States Refining and Mining Company. In 1923 the parent company acquired the Hammon Consolidated Gold Fields, the major dredging operation of the Nome region. From 1924 the company started investigating the Fairbanks region and acquiring properties. Large-scale dredging operations carried on until 1964. A major project supporting mining involved the construction of the Davidson Ditch, carrying water for mining from the Chatanika River to workings on Cleary, Goldstream, and other creeks for a distance of 90 miles.

Prospecting was done with churn drills using standard 6-inch tools and thin placer bits. Test results varied greatly because some holes penetrated old drift-mine workings while others were sunk in virgin ground left untouched by earlier miners. But since it had been determined early that even ground that had been previously mined could be dredged profitably, the company could make a reasonable assessment of the values of various properties. In acquiring properties the FE Co. benefited by the general doldrums in mining activity at the time. Most miners realized that long-term production from their claims could only be achieved through dredging and were receptive to sale or lease offers. The lease option offered by the company was a strong inducement to miners who believed their claims were rich and wished to retain a share of expected earnings.

The eight dredges operated in the Fairbanks area moved much earth. In the first stage of the operation the ground had to be stripped and thawed, then flooded for the dredge's passage. After dredges finished their work on Goldstream, Cleary, Pedro, Fish, and Cripple creeks in the 1920s and '30s, some were moved, at great difficulty, in the 1940s and '50s to new ground on Fairbanks, Chicken, Eldorado, Dome, and Ester creeks.

In 1936-37 F.E. Co. departed from conventional mining methods and developed an experiment underground hydraulicking system on the Chatanika River opposite Ruby Gulch. The bedrock on this particular ground was too deep to dredge, and drift mining would have been prohibitively expensive. Miners sank a shaft to 52 feet to reach gravel, cribbed the shaft in local spruce, then thawed the ground from that level with 10-foot steam points, finally reaching bedrock at 172 feet. An 8-by-8-foot station was excavated at this level. Then a main and several crosscut drifts were driven along the bedrock, and the areas were thawed. The pay gravel and bedrock were hydraulicked into a main drift extending from the shaft, then hoisted out in sluice boxes. Water from Davidson Ditch was used for both underground hydraulicking and cleanup on the pay pile. Though the technical method worked, the results were not profitable as costs proved far higher than the bedrock yield of gold. [3]

Operations resumed after the World War II shutdown. The number of dredges operating at Fairbanks, Hogatza, Chicken, and Nome (the other area of operations that compared with Fairbanks in scope) varied from year to year. In 1940 Fairbanks had eight dredges and Nome had three. Peak post-war years were 1957 and 1958, when Fairbanks had seven dredges and Nome had three. Hogatza had one from 1957 through 1974; Chicken had one from 1959 to 1968. The Nome mining was discontinued in 1962. The last two dredges operating at Fairbanks shut down in 1963. In the last few years other mining companies have become active in the Tanana Valley, and dredges have been operating near Nome.

Some statistics indicate the importance of the FE Co. operation to Fairbanks from the 1920s until the operation ended:

FE Company's Impact in Alaska, 1910-1969

| Year | Population Fairbanks |

Population Alaska | Company Employees |

Annual Payroll |

| 1910 | 3,541 | 64,356 | ||

| 1915 | 2,348 | 59,710 | ||

| 1920 | 1,155 | 55,063 | ||

| 1925 | 1,628 | 59,428 | 611 | |

| 1926 | 1,725 | 60,301 | 1,372 | $1,032,408 |

| 1930 | 2,101 | 63,793 | 851 | 831,046 |

| 1935 | 2,778 | 68,158 | 903 | 1,955,070 |

| 1940 | 3,455 | 72,524 | 1,163 | 1,955,070 |

| 1943 | 4,151 | 89,360 | 66 | 123,170 |

| 1945 | 4,613 | 100,579 | 247 | 275,323 |

| 1950 | 5,771 | 128,643 | 967 | 1,481,934 |

| 1955 | 9,341 | 177,405 | 871 | 2,204,757 |

| 1960 | 13,311 | 266,167 | 329 | 1,165.503 |

| 1965 | 14,041 | 264,170 | 99 | 347,870 |

| 1969 | 14,625 | 50 | 143,575 | |

| Total payroll 1926-1969 was $50,552,175. [4] | ||||

These statistics do not include the successful dredging operations within Yukon Charley Parklands on Coal and Woodchopper creeks (see Chapter 15).

Evaluations and the USGS

The advances of mining technology, spurred by inventions and adaptations to the northern environment, were of immense importance. Quite simply, a better method lowered costs to improve profits or, often enough, to make mining feasible where it had not been earlier.

The development of the great Fairhaven Ditch on the Seward Peninsula, which crosses national park lands, is one example of an obvious technological need. Fred H. Moffit of the USGS investigated the Candle area in 1903, noting that the Kotzebue Sound region had produced $415,000 from 1901-1903. Miners could not expect to carry on without improving their methods. The season was very short, and only very limited quantities of water were available for sluicing. Something must be done, Moffit argued, or the operation would cease. The miners agreed and, fortunately, investors came forward with enough capital to build the longest water supply system in Alaska. [5] One indication of the magnitude of ditch construction for mining is in the total mileage of ditchworks on Seward Peninsula—some 700 miles.

It was the responsibility of Moffit and other USGS men to consider aspects of mining costs as they investigated a particular region. But the USGS also examined the general problem of mining costs on occasion. Chester W. Purrington of the USGS provided the first overall analysis of methods and costs in 1905. At the time most miners used open cut methods—either pick and shovel or mechanical means—or hydraulic methods. Sixty per cent of the placer mining relied upon open cutting methods, then considered the most economical modes. Purrington examined the merits of steam scrappers, steam shovels, and hand shoveling.

Drift mining was still a popular method used. It permitted underground work over the winter but required the thawing of auriferous gravels twice—once for removal, then again in sluicing down the dumps. Drifting was much preferred in frozen ground where it was not necessary to timber the tunnels.

Hydraulic mining was considered "the most economical method from the standpoints of power, capacity, and labor." But it was wasteful of water and limited to areas where topographical conditions made it feasible. Such areas were not common in Alaska "even in mountainous districts." [6]

In looking at the early efforts of dredges, Purrington was not notably optimistic about their value in Alaska. He conceded that the Yukon and other valleys were wide enough to accommodate the machines that had been used successfully in California but saw other inhibiting factors, particularly the frozen ground. No existing dredge was strong enough to dig frozen gravel, and the advance thawing with steam points or other means would be expensive. He figured that most Alaska gravels would not yield more than 15 cents a yard, and even at Oroville, California, recovery costs had been eight cents a cubic yard.

The only dredges Purrington examined in the North were on the Stewart River and in Atlin in Canada, but he also reported on a New Zealand-style dredge on Bonanza Creek in the Klondike. There were no dredges in Alaska's interior and only a couple on the Seward Peninsula. Conditions did not appear favorable to Purrington. He did not have much data on costs but calculated that costs would run to 49 cents per cubic yard for unfrozen ground and 80 cents on frozen ground. At such costs mining would not be practical in most regions.

Subsequent developments in Alaska showed Purrington was overly cautious about the future of dredging in Alaska. By 1914, 42 dredges produced 22 percent of Alaska's gold, in 1924 only 28 dredges operated but they produced 51 percent of that year's placer production.

The success of dredges in Alaska came with the development of diesel engines and other means of reducing power costs and advances in cold-water thawing. In the 1920s the Alaska Railroad's construction helped reduce costs further, and an extensive dredging operation started in the Fairbanks region. In 1927, the USGS forecast "a new era" for dredging, "with prospects for success, particularly in the Nome, Fairbanks, and Kuskokwim districts." [7]

Dredge technology had also improved tremendously between the times of the Purrington and Wimmler reports. Earlier dredges were "often of freakish construction," and included so-called land dredges, dipper and suction machines that did not work. Early bucket dredge designs had often been too primitive for success. Eventually operators learned to avoid large dredges for inaccessible districts and confine bucket size to 2-1/2 to 5 cubic feet. They learned, too, to insist upon strong construction to limit breakdowns and to maintain machine shops and spare part supplies to forestall loss of time during the working season.

For average Alaska conditions, where gravels were no deeper than 20 feet, a combination dredge was utilized, using a revolving screen, flume, and conveyer. The stacker or California dredge was used for gold that was difficult to save and in deep deposits. Operators also learned how to move dredges from one area to another, sometimes over distances of several miles. Moving dredges after dismantling and cutting the hulls was costly—up to $28,000 but since the costs of dredges was from $100,000-$500,000 moving could be practical. Over time, methods of saving gold that might otherwise disappear into the tailings were greatly improved with better screens and other means.

Preliminary mining requires the stripping of the overburden of moss, sod, muck, sand, and gravel except in drift mining or where artificial thawing is utilized. Generally, the removal of the overburden a year or two in advance of mining allowed thawing of the gravel beneath it. Stripping costs had to be kept low to make most mining operations profitable. An adequate water supply was essential for stripping unless hand methods, plows, drags, or scraper were not used.

A region might have several active periods of production, depending upon available technology and other economic factors. Many placer fields were mined, then abandoned when the yield decreased, then mined again when mechanical methods and/or reduced transport/supply costs made work attractive. In the 1920s Norman L. Wimmler of the USGS investigated costs in 50 placer regions and synthesized reports of earlier USGS men and territorial mine inspectors.

Statistics showed that from 1908 to 1923 the value of gold recovered per cubic yard had decreased from $3.74 to $.60 but that the total quantity of gravel mined had increased proportionately. Much of this shift followed the great increase in operating dredges after 1908. Only four dredges operated in 1908 but 14 in 1909 with subsequent increases to reach a peak of 42 in 1914.

By 1927 hand mining, with a minimum outlay for equipment for ground sluicing and shoveling in, was practiced only by a few miners content with a small return. Drift mining was declining as well, but was still used for deep channel deposits at bedrock beneath frozen gravel.

When dredges were not practical, miners relied on other mechanical means—open cut by steam scrapers, drag lines, excavators, or hydraulic mining. Hydraulic mining was only practical in small areas where the water supply was adequate.

Wasteful Mining

Alaska miners and investors could look to many publications, including technical and investment journals, for information on mining techniques and prospects, but all sources had to be used with caution. USGS made the government's chief contribution to technical mining information. Miners relied on its reports on regional geology and mining activities and what local knowledge they could gather in charting operations. Often information was hard to get. Operators were not inclined to reveal their gain of gold and the working costs per cubic yard—the basic statistics that determined a mine's profitability. If other mining men had ready access to this information, their ability to evaluate properties would have been greatly improved. Comparative records, for example, could show what kind of mining technology would be most effective with geographic conditions. But since mining traditions favored secrecy, the hit-and-miss system prevailed.

A USGS geologist in 1907 lamented the installation of equipment upon ground that had not been properly tested—a practice which caused three-fourths of the economic failures. Millions of dollars were being wasted on properties for which "the gold content or the working cost per cubic yard is not known within 25 per cent of the real figures." [8]

Bonanzas were rare and essentially unimportant to the general public because bonanza developers did not need to seek outside capital. But information was needed for less rich ground, and USGS expert John Power Hutchins summarized the means by which adequate testing could be achieved:

Proper prospecting involves the determination of the following more important factors: (1) Volume of pay alluvium; (2) extent, value, and distribution of pay streaks; (3) character of alluvium; (4) its degree of induration; (5) distribution and character of boulders; (6) distribution and character of clay; (7) depth of alluvium; (8) depth to ground water; (9) character of bed rock. In addition to these, in Alaska, there is the prime necessity of investigating the distribution and character of ground frost, both permanent and seasonal. All the above factors influence working cost . . . It is safe to assume that in most Alaska placer camps labor and supplies will cost at least 100 per cent more than in the States.

Information, Hutchins observed, could be gained by drilling or sinking shafts: By the drilling method small samples are obtained. Briefly, out of each drill hole a cylinder of material about 6 inches in diameter is obtained from grass roots to bed rock. A prospecting shaft 3 by 6 feet has a cross-sectional area about 50 times as great as that of the drill hole. Thus the volume of material obtained from the shaft is often 50 times as large as that from the drill hole.

Clearly, mining practices into the early years of this century were wasteful. It had been one thing to push ahead in disregard of sound testing methods during the heat of early gold rushes, but once the excitement simmered down in a district rational investigation of prospects should have begun. Of course, testing could be costly and time-consuming and of no real advantage to claim holders more interested in speculative sales than mining. For such holders, the goal was to promote the property, to present it in glowing terms, and attract purchase bids. Promoters did not always wish for a careful scientific scrutiny of their claims. They offered a prospect of wealth rather than the certainty of wealth. After all, a buyer who really wanted a "sure thing" could buy into a working mine with an established record, but it cost plenty to gain a measure of certainty.

Speculation

Investors in the Klondike and Alaska gold field included major financial interests and individual share buyers. The flow of capital into northern mining was swift and enormous. New companies, formed to buy mines or provide provisioning and transport, capitalized at totals far exceeding the highest estimates of expected gold production for several years. Many of the new companies failed to raise the capital they desired, but even so huge amounts of capital were available for northern enterprises. In New York the Yukon-Caribou-British Columbia Gold Mining Company was capitalized at $8,000,000; the Northwest Mining and Trading Company authorized 5,000,000 shares at $1 each. Stock issues of $1,000,000 and up were commonplace in New York, and there were many other companies capitalized at more modest amounts.

But New York was not alone in its bid for stockholders keen on Klondike investment. In other eastern cities in the Midwest, South, and on the Pacific Coast, hundreds of other companies vied for the investors' dollars. Chicago's major stock offering was by the North American Trading and Transportation Company of John J. Healy, Portus Weare, and the Cudahys. Stock for $25,000,000 was authorized. Overall, millions of dollars were made available for spending in a region that had never before experienced anything but a skimpy trickle of investment from a few trading companies. The money flowed in, and the people carrying it determined a permanent, economic revolution.

Individuals who were not familiar with the mining scene viewed the speculations with alarm. Capt. P.H. Ray of the U.S. Army saw how Circle miners suddenly rushed to Dawson in response to a stock promotion. Promotional efforts by Dawson interests panicked miners at Circle. He also observed that the Rampart miners touted their claims with future sales in view instead of working them. Writing to his superior Ray reported:

[O]wing to rumors of extensive sales of claims in the Klondike district, an exodus from this Territory to Dawson has commenced in this vicinity, and I am informed by Collector Smith at Circle City that all who are able to do so are leaving there. This is the natural result of the failure to discover any new mines in Alaska, as all interest is centered in the few very rich claims in the Klondike, and excitement is again stirred by purchases for speculation. The spirit that generally prevails among the people in this country is not one to be satisfied by any reasonable return for their time or labor, even where they are willing to work, but they have come here expecting to obtain great riches by some means or other than they have heretofore known; consequently they all flock where very rich deposits have been found. They see only the gold that has been taken out, but do not stop to consider that the same expenditure of labor and money in mines that, though yielding less per yard, but which could be worked cheaply, certainly would yield far better returns in the aggregate. To the masses everything is misleading and false except cold and hunger, and they are accordingly bitter and resentful at what they term their bad luck. I hear only far reports from Manook (Rampart City), the only mining camp in North Alaska besides Birch Creek, but nothing reliable as to any claims paying largely or at all. In my opinion they are only preparing for sales to the people expected up the river next spring. Up to date there is nothing in sight or reported to justify the great excitement the discoveries in Northwest Territory started, or to avert a collapse of the many schemes now being promoted in the States to float stock based on alleged mines in Alaska. The advertising given this country by the newspapers, transportation companies, and mining companies has become criminal in view of the distress and suffering it has caused." [9]

Ray's reporting showed his inexperience with the mining scene and his small regard for the intelligence of civilians. He may have been right about the superior reward involved in sustained labor, but miners knew that fortunes generally fell to those who got to new ground at the right time.

Promoters

Promoters of mining companies and supporting enterprises like trading and transportation outfits were key individuals on the frontier. Their legitimate endeavors provided the capital necessary to development and pressure on the government to increase services to the community. Neither investors nor miners could trust the more visionary promoters regardless of their essential honesty. Promoters, exuding faith and confidence, usually depended upon the "expert" opinion of others in crying up a mining property. Sometimes they were wrong. Similarly, promoters lacked the power to see the future perfectly, so their forecasts of population trends, government actions, world events, and other factors affecting their projects sometimes rested on shaky foundations.

The public had long disdained promoters. Promoters were ranked with experts (and sometimes professed to be experts), a class many miners believed "don't know beans" about mines. Such "experts," according to the strongly held opinion among practical miners, were confidence men who parted their hair in the middle and wore eyeglasses and diamond pins to attract the gullible.

Enumeration of the many northern promoters of the honest or the crooked kinds would be impossible. Many small-time miners became instant promoters of their own prospects and sometimes did better selling out than working their claims. Salting one's mine to encourage great expectations was not considered any great crime, particularly if the deceit went undetected. But even scrupulous men could victimize each other with the fervor of their own hopes.

Promoters did not take kindly to the resistance of investors. In pushing for his Seward Peninsula tin claims, John J. Healy advised friends that an English company was moving in:

It takes the English to mine tin. They know a good thing when they see it . . . I am sorry to say that New Yorkers are becoming even worse, as they want the good things of the earth placed in their hands. In less than 12 months, you will see the American tin dealers ruing their lack of enterprise. Good miners don't always have to go begging. [10]

An unfavorable report by the U.S. Geological Survey was a distinct aggravation to promoters like Healy. He had his own theories concerning the geological conditions conducive to mineral discovery and sharply censured Alaska's long-time USGS geologist, Alfred H. Brooks:

I am no admirer of Brooks. He appears to make his reports from the mass of information furnished by his assistants and supplements it all by introducing some of his own pessimistic themes. The development of the Tanana and the Kuskokwim will confound them. I pay little attention to their opinion.

Old prospectors knew better about mining: "What is wanted is a man." [11]

Healy also disparaged the big mining corporations who hoped for "a cinch" and were keen to squeeze out rivals by pretending to dismiss their optimistic findings. There were various kinds of promoters; some were honest; some were suspect: "I represent the hard working prospector, who devotes his life in pursuit of something which will keep him in food and clothing. His chances can not be thrown away." Healy intended to determine the value of his claims regardless of expert opinion: "An expert is useless. What is wanted is powder, steel, and having some good men to use them." Healy needed $25,000 and hoped to expose a dozen new lodes worth millions: "No use in sending experts to look at surface indications. The money they waste will do the work. An expert follows the prospectors and miner." [12]

Eugene Owens, another mining man, echoed Healy's theme of the need for development money and his disdain for those unwilling to take risks: "My idea is to get a few prosperous businessmen who can afford to spend a few thousand dollars in development work. I do not mean by prosperous businessmen such cheapskates as mining engineers and lawyers or ex-Cape Nomers or Yukoners, but men willing to pay for a few open cuts to recover ore." For a little money, such determined men could prove his claim's values "then could turn it over for a good price." [13]

Promotional and Professional Literature

Promotional literature did not differ much from any other product advertising copy. Much was promised while risks were downplayed. Iowa backers of the Clear Creek Mining Co. in the Koyukuk offered 50,000 shares of capital stock in 1898-99 at one dollar per share. The 17 company organizers had a claim "two miles long" ripe for development: "The actual expense, aside from wages, will be next to nothing, as water can easily be brought onto the bench; only provisions, a steamer, and a launch were required." Here is a chance of a lifetime. "You cannot afford to let it pass. Your hopes of realizing on your investment are not based on the luck that might attend some prospector in that frozen country." Clear Creek gold assayed at $19.70 to the ounce, "the purest ever found in Alaska," and existing "in such quantities that experienced mine operators declare there is no question but that it will pay good dividends." [14]

Clear Creek promoters did not treat potential investors as ignorant plungers. Their brochure explained the planned method of working the gravel benches and described geological conditions favorable to development. "Mine faces the south, hence the sun does good work in thawing the ground. Work can be prosecuted from twenty to twenty-four hours every day for three months." Backers also distinguished their efforts from many others going on in the Koyukuk: the country was known to them and further prospecting will go forward at Clear Creek's headwaters in the spring: "We offer shares in a company that already owns an immense claim that is going to send another expedition into a country they know is rich and under "MEN WHO HAVE BEEN THERE BEFORE." [15]

Alaska's mineral prospects seemed to promise limitless opportunities for wealth. It did not seem unreasonable that its vastness held many other sections to equal those golden finds along the Yukon, in southeast Alaska, and the Seward Peninsula and the spectacular copper deposits exploited by Kennecott. Promoters' greatest asset in attracting investment lay in the general public conception formed in the Klondike stampede days that the region abounded in fabulous riches.

More informed opinion expressed caution to counter the glowing optimism favored by Alaska miners and speculators. In The Copper Handbook: A Manual of the Copper Industry of the World (1905) editors issued a severe warning: "It may be said, in a general way, that there is much copper in Alaska. It may also be said that there are many and able liars in Alaska. There is little question that the various placer gold camps of interior Alaska and the Yukon have been systematically boomed by an organized claque, to the benefit of sundry transportation and outfitting firms." Misleading press dispatches concerning gold were giving way to "systematic promotion of a copper mining boom." Watch out, warned the author, "the reported finds of mountains of pure copper must be taken cum grano salis. Attracting investors far from Alaska was a deliberate strategy for promoters because Alaska is "a terra incognita, where all things are possible, and a country of such magnificent distances that the natural-born liar finds opportunities of outdoing his own best records." [16]

The Handbook warned specifically of the Copper River Mining Co. which "lays claim, apparently without the slightest ground," to the famed Bonanza mine. "Company is regarded as a stock-jobbing scheme of the most brazen sort, and its promoters considered as a more than doubtful lot." Similarly, editors warned of the Nizina Gold and Copper Co. of Alaska: "Property may prove valuable, if properly developed, but was lied about shamefully in the advertisements of its fiscal agents, when peddling stock." Another company, the Valdez, Copper River and Yukon Railway Co. was dismissed as "a stock-jobbing proposition, promoted by the notorious L.E. Pike and Co., Boston." [17]

While investors could benefit to some extent from such information as the Handbook and other professional publications offered, a favorable report on a company did not guarantee its reliability. The Handbook reported well on the Reynolds-Alaska Development Co.'s holdings of 33 patented claims in the Valdez area in addition to timber, coal, and oil lands: "Company is free from debt and has clear title to lands, and property seems to be well managed and promising." Yet, within a couple of years, perhaps because of Henry Reynolds overreaching and disastrous Home Railroad project, the company crashed totally.

Railroad Promotion

Investors were also attracted to enterprises relating to mining, particularly transport schemes. Thus when George Hazelet wrote to Tom Donohoe in 1901 "on the dead quiet," that the railroad from Valdez to the interior was coming soon, Donohoe's interest was great, especially in hearing that James Hill, the great western railroad magnate, was keenly interested. Another great feature of Hazelet's plan was in his ownership of the terminated site at Valdez. [18]

Hopes and speculation centering on railroad prospects stirred miners and others to transports of passion—especially if, like Hazelet, they had terminal townsite interests or claims that depended for development on better transportation facilities. Paper railroads puffed and chugged across tons of promotional brochures, stock certificates, newspaper stories, government reports, and business correspondence, whistling of success and of fortunes to be made. It was always so obvious to promoters that their railroad was urgently needed and certain to profit. Many promoters actually got far enough to commission a survey of the route and a handful even laid rail. Promoters were interested primarily in profits but railroad ventures offered more glory and romance than other commercial ventures. A man who promoted railroads was a bona fide visionary, a patriot, a heroic builder who might join the ranks of greatly celebrated captains of finance like James J. Hill and Edward Harriman.

Hazelet was not a full-time railroad promoter by any means. Most railroad adventurers devoted only a portion of their energies to transportation projects because their capital and time were already committed to mining, commercial, or townsite interests. John Rosene, Henry Reynolds, O.P. Hubbard, Richard S. Ryan, and others who participated in planning short- or long-line railroads that were actually built in whole or part necessarily focused on transportation, but many others only dabbled in it. Vast sums of money for construction were not easy to come by, and most promoters did not pursue their visions when capital was not immediately forthcoming.

John J. Healy's vigor in touting railroad after railroad suggest an obsession, despite that he always had other endeavors going simultaneously. On the Seward Peninsula, Healy's short-line railroad would have served his tin claims and his shipping townsite; in Yakutat another short-line railroad would have supported his lumber interest; but his Valdez-Eagle railroad would make a fortune by opening the interior rather than through exploitation of any of his local properties. With his grandest project, the trans-Siberian railroad, Healy's interests included a Port Clarence townsite, but perhaps his primary motivation for the ill-starred scheme was in the grandeur of the conception—and its potential for making the fame and fortune of its promoter.

More railroads were promoted than were constructed, but it should be noted that besides the Alaska Railroad and the Copper River and Northwest Railway there were a number of short lines that served mining operations, including the Tanana Valley Railroad and the Seward Peninsula Railroad.

Litigation

Mining was an uncertain enterprise by the nature of its hidden wealth. It took time and money to learn a claim's value. But there were other uncertainties as well that affected production and transfer of title. A miner's property could be threatened in a number of ways. Floods might sweep away equipment and other vagaries of nature, like a late spring or early winter, could slow work and raise costs.

But the perils of nature were less often disruptive than the machinations and intrigues of men—greedy men, or, sometimes, just men pursuing an honest cause. Such interference usually took the form of litigation, a process that was invariably costly in time and money. How many miners gave up claims because of lawsuits or threats of lawsuits? Calculation, or even estimation, of numbers is not possible, but litigation was part of the experience and a cost factor to most miners—a major cause of their teeth gnashing, frustration, and wailing. Anyone with a personal claim against a miner for supplies, services, or other things could ask for a lien against his property. In this respect, the miner was not more vulnerable than any other entrepreneur, but the practice of claim jumping was singular in the mining industry.

The practice in Alaska accelerated during the Nome stampede of 1898-1900 and extended to other regions. Most claim jumpers believed, or professed to believe, that the established holder of a mining claim held it invalidly. The legal challenge by a jumper forced litigation or settlement by one means or another. Much of the Seward Peninsula claim jumping derived from jumpers' beliefs that the original discoverer of the most valuable properties were aliens who were not entitled to title. In fact, aliens' rights were not inferior to those of citizens, but the wave of jumping swept over the peninsula to create chaos before the issue was finally clarified.

Claim jumping elsewhere in Alaska did not approach the intensity of Nome, where the huge influx of prospectors, the muddled understanding of mining law, and the abuse of power-of-attorney filings created much havoc. But its occurrence elsewhere was common enough and a great source of anxiety among parties to a dispute. One incident in the Koyukuk involved a jumper's recourse to the supposed restriction on alien ownership. N.E. Nelson staked on Emma Creek in June 1900. A month later, V.G. Crocker, concluding that Nelson was not a citizen, recorded the claim. Subsequently, Nelson sold out to Virgil Lowery, who recorded the claim. Crocker sold parts of his claim to buyers, then the title was clouded further by John Schwartz who jumped in January 1901 because the necessary assessment work have not been performed. Then Joseph Matthews decided to stake because, so he said, Lowery had abandoned the claim. Lowery died, and his heirs brought a quiet title action against Crocker, Matthews, and others. Some four years after the original discovery, the court dismissed the case for the plaintiffs' failure to pursue the issue. Obviously, by this time, regardless of the legal issues, all parties had determined that the claim lacked enough wealth to sustain interest. [19]

Hundreds of examples could be cited of litigation tying up properties. If claim jumping was not a problem, civil actions against operators for recovery of damages in tort or contract violations might force the temporary or permanent closing of operations. It would be impossible to estimate the total costs of various forms of litigation to miners, but it was tremendous.

Transportation

The progress of mining in many instances depended upon and followed the development of transportation. Riverboats, trails, roads, and traveler support services were essential components of the socioeconomic mining frontier, and important aspects of these deserve separate historic consideration.

Yukon Traffic

Tracing the quantities and general destination of cargo shipped up the Yukon from 1897 to 1911 shows the continued importance of the route. Peaks during the Tanana and other gold rushes occurred, but the overall growth of traffic shows the stability of population in the interior:

Freight Shipped Upstream from St. Michael: 1897 to 1911 [20]

| Year | Total Tons |

To American Yukon | % to Canadian Yukon |

Yukon |

| 1897 | 5,270 | 1,720 | 3,550 | 67 |

| 1898 | 22,117 | 7,997 | 14,120 | 64 |

| 1899 | 17,295 | 5,215 | 12,080 | 70 |

| 1900 | 19,170 | 5,580 | 13,490 | 70 |

| 1901 | 18,153 | 4,562 | 13,591 | 75 |

| 1902 | 17,008 | 5,824 | 11,184 | 66 |

| 1903 | 20,000 | 8,965 | 11,035 | 55 |

| 1904 | 17,356 | 14,077 | 3,279 | 19 |

| 1905 | 25,855 | 22,381 | 3,474 | 13 |

| 1906 | 31,999 | 30,383 | 1,616 | 5 |

| 1907 | 29,793 | 27,049 | 2,744 | 9 |

| 1908 | 23,785 | 21,758 | 2,027 | 9 |

| 1909 | 29,921 | 29,096 | 825 | 3 |

| 1910 | 24,462 | 24,098 | 364 | 1 |

| 1911 | 3,669 | 31,534 | 2,135 | 6 |

Yukon Steamers

Yukon traffic remained heavy even after the peak years of Dawson's gold yield of 1897-1900. Dawson continued to be an important population and trade center as new gold discoveries in Alaska created plenty of activity and the need for boats and barges. A survey of active vessels made by the Northern Navigation Company in the early years of the century shows the fleet available and its carrying capacity:

Steamers on Yukon River, Alaska

Headquarters, St. Michael

| Name | Tonnage |

| Louise | 717 tows three barges 300 tons each |

| Sarah | 700 |

| Susie | 700 |

| Hannah | 700 |

| Alice | 400 tows one barge 300 tons |

| Belle | 370 tons two barges 300 tons each |

| Margaret | 520 |

| Leah | 470 |

| City of Paris | 300 |

| Linda | 692 tows one one barge 300 tons each |

| Loon | 692 tows one one barge 300 tons each |

| Arnold | 692 tows one one barge 300 tons each |

| Herman | 456 tows one one barge 300 tons each |

| F.M. Gustin | 716 tows one one barge 300 tons each |

| T.C. Power | 819 tows one one barge 300 tons each |

| John Cudahy | 819 tows one one barge 300 tons each |

| P.B. Weare | 400 |

| C.M. Hamilton | 595 |

| John J. Healy | 450 |

| John C. Barr | 546 Foreign bottom owned in U.S. |

| St. Michael | 718 |

| Victoria | 718 |

| Seattle | 718 |

| Tacoma | 718 |

| Seattle No. 3 | 548 tows one barge 600 tons each |

| D.R. Campbell | 718 tows one barge 600 tons each |

| Milwaukee | 395 |

| Rock Island | 400 |

| Hideout | 300 estimated, tows one barge 600 |

Alaskans had to develop a certain mental attitude towards transportation—a toughness enabling them to accept frequent delays and high costs as part of their culture. Something of this essential spirit was addressed in a poster placed prominently on the steamboats of the Northern Navigation Company and the message could be applied equally to all forms of transport:

NOTICE

We desire to be courteous and to answer all questions not frivolous. Business on these Northern Waters is like a game of cards. Nature always holds a joker and a few of the best trumps besides, in the guise of LOW WATER, SWIFT WATER, and FROST. The cards are played against our connecting lines which spoils our play to a great extent. We have a 100 days to do a years work. These conditions make business expensive, and necessitate high rates. The cost of operating is about five times that of similar service in more favored climates. The high rates extend to all lines Mercantile and professional business, and are what attracted you to this country—SO DONT KICK. We are doing the Best possible against a hard and remorseless opponent. We are frequently without sleep 24-36-and 60 hours at a stretch. So if you find us irritable lay it to that and try to take as little of our time as possible to transact your business.

Earnestly yours,

Northern Navigation Co. [22]

Overview

Mining induced capital investment and encouraged the development of transportation. Mining was responsible for the founding of numerous communities, including several like Fairbanks and Juneau which are among the state's larger communities and a good number of ghost towns. Mining history is often celebrated as if it ended with a whimper with the World War II restrictions but, in fact, production continues in many regions.

Notes: Chapter 9

1. Charles A. Bramble, Klondike: A Manual for Goldseekers (New York: R.F. Fenno, 1897), 206-207 for this and following quotes.

2. Philip Smith, Mineral Resources of Alaska in 1936, USGS Bulletin No. 897, (Washington, D.C.: GPO, 1938), 68-71. The statistics, "Gold Produced by Dredge Mining," are from the same source.

3. John Boswell, History of the Alaskan Operations of the USSR&M Co. (Fairbanks: MIRL, University of Alaska, n.d.), 55-56.

4. Earl Beistline, "The USSR&M," in Mining in Alaska's Past (Anchorage: Alaska Div. of Parks, 1980), 281.

5. F.T. Moffit, Fairhaven Gold Placers, USGS Bulletin No. 247, (Washington: GPO, 1905), 71.

6. Charles W. Purrington, Methods and Costs of Gravel and Placer Mining in Alaska. USGS Bulletin No. 263, (Washington: GPO, 1905), 99.

7. Norman L. Wimmler, Placer-Mining Methods and Costs in Alaska. USGS Bulletin No. 259, (Washington: GPO, 1927), 177.

8. Alfred Brooks et. al., Mineral Resources of Alaska: Report of the Progress of Investigation in 1907 USGS Bulletin No. 345, (Washington: GPO, 1908), 56-58, for this and following quote.

9. Ray to Adjutant-General, January 13, 1986, P.H. Ray and W.P. Richardson, "Suffering and Destitute Miners in Alaska," Compilation of Narrative of Exploration in Alaska. Senate Reps., 56th Congr., 1st sess., No 1023, (Washington, D.C.: GPO, 1900), 553.

10. Healy to Adney, February, 1906. Adney Collection, Dartmouth College Library.

13. Owens to J.W. Bixby, July 10, 1931, W.A. Dickey papers, UW.

14. Clear Creek Mining Co. brochures, Wm. Michaels Collection, UAF.

16. The Copper Handbook, Vol. V (Houghton, Mich.: Horace J. Stevens, 1905), 97-98.

18. Hazelet to Donohoe, December 2, 1901, Donohue Collection, UAF.

19. V.V. Lowery v U.G. Crocker, Case #54, RG21, FRC.

20. U.S. Alaska Railroad Commission, Railway Routes in Alaska, House of Representatives, 62nd Cong., 3rd sess., House Doc. 1346 (Washington, D.C.: GPO, 1913), 155-156.

21. James T. Gray Collection, date uncertain, University of Oregon Archives.

| <<< Previous | <<< Contents>>> | Next >>> |

golden_places/chap9.htm

Last Updated: 01-Oct-2008